Why Do People Trade Penny Stocks?

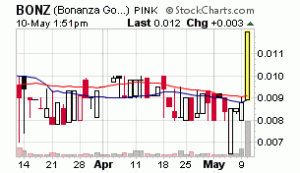

Do you know the number one reason people trade penny stocks? They have the potential for MASSIVE GAINS which does not exist anywhere else in the financial markets. Everyday within the penny stock market there are individual stocks that double and triple in share price, in some cases even more. Finding these hot penny stocks for our subscribers is what we do. No doubt there are risks involved with penny stocks as there are with any form of trading or investing. By learning to understand market dynamics and the nature of the penny stock market as we do, the possibility for greater rewards increase substantially. You may be new to the stock markets and have never heard of penny stocks or a seasoned investor with experience in the financial markets but have never looked into the possibility of penny stocks. The first question you may be asking yourself is why do penny stocks possess such explosive potential?

Penny Stocks and Their Explosive Power

Large cap stocks seldom have the ability to double or triple within a short period of time, if at all. Hot penny stocks can make 1000% increases in a couple of days or even one day! Why…? It is far much easier for a penny stock trading at five cents to double to ten cents than it is for a stock trading at $20 to increase it’s share price to $40. Thousands of penny stock traders and investors understand the MASSIVE GAINS that can be had by building a list of penny stocks that would otherwise not be obtainable by trading only large cap stocks.

Trading the penny stock market does have its risks and careful consideration should be given to your approach to this highly volatile market. Experienced penny stock traders understand the importance of sound money management and stick to their trading system. They don’t trade with “scared money” and neither should you.

Penny Stock Picks and Using Newsletters

Many traders utilize stock newsletters, like ours, to help them find penny stock picks to eliminate the hours of research they would otherwise have to do in order to find hot penny stocks on the move. We scan thousands of stocks looking for those which have the potential to become the next big winner for our subscribers. Most of our subscribers started out as new traders and investors with little experience in penny stocks, opened a trading account, funded it with a small amount, used common sense along with our guidance and have since become successful and profitable. YOU can too!

Get Free Email Alerts About Hot Penny Stocks!

Our hot penny stock newsletter is free when you sign up for our email alerts. Everyday we send out email alerts to our subscribers with hot penny stock picks from our professional staff. We look for stocks with the momentum to move to the next level and is the number one reason why momentum players love our email alerts. By signing up for our free email alerts, you too can ride the wave of momentum of hot penny stocks!

![gold-catch1[1]](http://shakerzandmoverz.com/wp/wp-content/uploads/2014/05/gold-catch11-300x209.jpg)